BIR Official Receipts – Frequently Asked Questions

BIR Official Receipt Implementation and Company Voucher Program

USANA adheres to the Bureau of Internal Revenue’s (BIR) requirement for Associates who receive commission payments to issue original Official Receipts on all commissions. Associates must complete and submit the following:

- Official Receipt for each commission week

- On each receipt, state the commission week it relates to.

- Write your Customer ID number on the face of each receipt.

- Commission Release Acknowledgement

Below, you’ll find frequently asked questions regarding this policy.

BIR Official Receipt FAQs

Q: Why do I have to submit an Official Receipt?

A: Section 237 of the Tax Code states all persons subject to an internal revenue tax shall, at the point of sale of goods or service valued at One Hundred Pesos (P100) or more, issue duly registered receipts or sales or commercial invoices showing date of transaction, quantity, unit cost, and description of merchandise or nature of service.

Q: How do I secure an Official Receipt?

A: The BIR has issued Revenue Regulations No. 7-2012 to consolidate revenue procedures for primary registration, updates, and cancellation. To secure Official Receipts, a taxpayer must undergo primary and secondary registration with the BIR:

- Primary Registration

- Secure Tax Identification Number (TIN)

- Register Business and obtain Certificate of Registration (COR) or BIR Form 2303

- Secondary Registration

- Secure Authority to Print Receipts (ATP) and register commercial documents used to conduct business, including but not limited to an Official Receipt.

- Register and maintain books of accounts—manual or loose-leaf books of accounts or a computerized accounting system may be used.

Q: Can I submit a sales invoice instead of an Official Receipt? What is the difference between an Official Receipt and sales invoice?

A: No. An Associate who earns commissions is required to submit a valid Official Receipt. Official Receipts must be issued for all sales of service, including commissions.Sales invoices are required to be issued for sales of goods. A sales invoice provides evidence the sale of goods has occurred and payment has come due for goods purchased.

Q: Where can I submit an Official Receipt?

A: Official Receipts may be submitted to any of the following:

USANA Makati Office

UHS Essential Health Philippines, Inc.

24F Tower 1, The Enterprise Center, 6766 Ayala Avenue Corner Paseo de Roxas

Makati City 1223

Contact Number: 8858-4500

Attention: Althea Mae Yu, Glenda Singh, or Mc Dexter Sanvictores

USANA Davao Office

UHS Essential Health Philippines, Inc.

7F Abreeza Corporate Center, J.P. Laurel Avenue

Bajada, Davao City 8000

Contact Numbers: 8858-4533 / 0920-9221668

Attention: Michelle Arcansalin

USANA Cebu Office

UHS Essential Health Philippines, Inc.

5F Tech Tower, Sumilon Corner Camiguin Road

Ayala Business Park, Cebu City 6000

Contact Numbers: 8858-4555 / 0917-7203733

Attention: Ivy Grace Caral

R.S. Bernaldo & Associates (RSBA)

18F Citiland Condominium 10 Tower 1

156 H.V. dela Costa Street, Ayala North

Makati City, Philippines 1226

Contact Numbers: 8812-1718 to 24

Attention: Elaida Jen dF. Avellanoza | uhs@rsbernaldo.com

Q: If I completed my BIR registration and submitted an Official Receipt in April 2021, should I submit receipts for all commissions earned since last year?A: No. Official Receipts registered in 2021 may be issued for commissions earned within the same year. If and when the Official Receipt was registered and printed after the start of the year, the Associate may issue just one Official Receipt for the aggregate currency amount of commissions earned during the same year, up to the printing of this valid Official Receipt.

Q: Why do I have a deduction from my commissions?

A: Failure to issue a valid Official Receipt on all commission income could expose USANA (“the Company”) to potential income tax and Value Added Tax (VAT) liabilities. As such, 30% and 12% (as applicable) will be deducted from your commission payout to be put in escrow. This amount will be released within three (3) business days upon your issuance of the required valid Official Receipt and Commission Release Acknowledgment Form to the Company.

Q: Is this also the case with any withholding tax and VAT?

A: No, the 30% and 12% (as applicable) deductions are different from withholding tax and VAT (refer to question 6).Withholding Tax—The Company is required by law to withhold applicable taxes from all commission payments to resident Associates, based on latest Revenue Regulations issued by the Bureau of Internal Revenue (BIR).VAT—The company pays Value Added Tax-Associates an additional 12% of their commissions. This amount should be remitted by the Associate to the BIR.

Q: How do I determine the 30% deduction?

A: The deduction is calculated based on your total gross earnings as an Associate.

Q: When will USANA be implementing the BIR Official Receipt policy and provisions?

A: The 30% and 12% (as applicable) deduction will take effect during our commission week ending February 19, 2021. This will be reflected on the payout received the following week.

Q: When will I receive the 30% back?

A: The 30% deduction will be released within three (3) business days of your issuance of the required valid Official Receipt and Commission Release Acknowledgment Form to the Company.

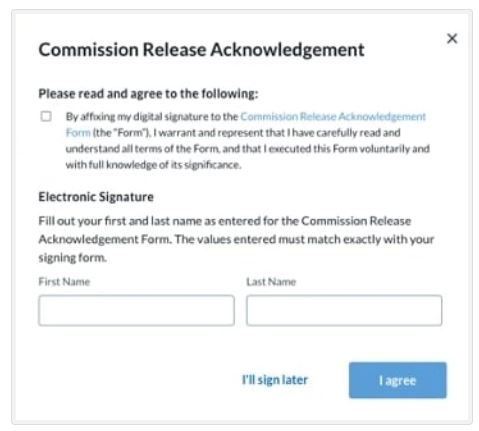

Q: What is the process to release the 30% deduction?

A: An Associate must comply with the following to release the 30% and 12% (as applicable) deductions:

Submit an original copy of duly accomplished valid Official Receipt to the Company. Refer to question 4 for submission options.

Submit digital Commission Release Acknowledgment Form located here on The Hub.

Q: Where can I access the Commission Release Acknowledgment Form?

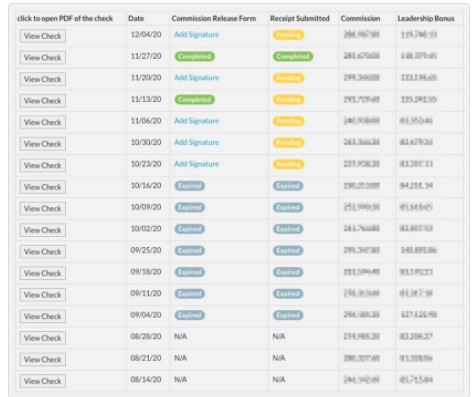

A: The Commission Release Acknowledgment Form (also called a CRA) can be found here on The Hub. You will be sent Hub notifications confirming the Company has received your Official Receipt, as well as notifications if you need to digitally sign a Commission Release Acknowledgment.

Below are the kinds of notifications you may receive through The Hub. Here, you can monitor your Official Receipt status and see whether you have digitally signed a Commission Release Acknowledgment.

Q: Can I print, sign, and submit a blank Commission Release Acknowledgment Form?

A: No. The system is not able to capture a manually signed hard copy of a Commission Release Acknowledgement Form. The Commission Release Acknowledgment Form should be signed digitally to facilitate processing for release of the 30% and 12% (as applicable) deductions.

Q: When is the deadline to submit an Official Receipt to release withheld commissions?

A: Associates are encouraged to issue a valid Official Receipt as soon as the commission amount earned for the past week is known.An Associate has until the second commission week following the end of the fiscal year to submit a valid Official Receipt, after which the 30% deduction will be automatically forfeited.A VAT Associate has until the second commission week following the end of the fiscal quarter to submit a VAT Official Receipt, after which the 12% deduction will be automatically forfeited.

Associates will receive a notification on the first day of the two-week grace period following the end of the fiscal year, along with notifications every two days thereafter, for the remainder of the grace period.

Q: If forfeited, can I include the 30% deduction in my annual tax computation?

A: As an Associate, it may be possible to treat your forfeited 30% deduction as an expense. Consult your tax accountant for further details.

Q: Are deductions applicable to all commission earners?

A: The 30% and 12% (as applicable) deductions would apply to those earning USD $200 or more until our April 23, 2021 commission week. Beginning the commission week of April 30, 2021, the 30% and 12% (as applicable) deductions would apply to those earning USD $100 or more.

Q: Why is a 30% deduction required for all commission earners?

A: As mentioned in question 1, Official Receipts are required to be issued for transactions valued at P100 or more. As mentioned in question 6, if an Associate fails to issue an Official Receipt, they are exposing the Company to possible tax and VAT liabilities, hence the 30% and 12% deductions. These deductions are retained by the Company until such time the Associate complies with the Official Receipt and Commission Release Acknowledgment Form requirement. The amount retained does not reduce any earnings of the Associate and is merely held in escrow.The tax exemption is dependent on the aggregate annual income of an Associate.

Q: If I earn less than USD $200 per week, the company won’t deduct 30% from my commissions. Is this true for the whole year? Am I not required to submit an Official Receipt?

A: The 30% and 12% (as applicable) deductions would apply to those earning USD $200 or more, only until the commission week of April 23, 2021. Associates earning less than USD $200 will not be required to issue an Official Receipt until this time but are still encouraged to do so. An Associate should be ready to comply if and when their earnings exceed the threshold.Beginning the commission week of April 30, 2021, all Associates earning USD $100 or more will be subject to the same deductions.

Q: Say I earned USD $300 last week and USD $100 this week. Will 30% of my commissions be deducted from my income?

A: The 30% and 12% (as applicable) deductions apply only to earnings of USD $200 or more (until the commission week of April 23, 2021—see question 17). If an Associate earns, for example, USD $300 in a particular week, then the deduction would apply for that week, and each week moving forward.

To illustrate:

| Week 1 | USD $100 | Not subject to deduction and not required to issue an Official Receipt |

| Week 2 | USD $200 | Subject to deduction and required to issue an Official Receipt |

| Week 3 | USD $100 | Subject to deduction and required to issue an Official Receipt |

If at any point in time an Associate reaches the threshold requiring the issuance of an Official Receipt, they will be required to do so for any subsequent earnings, regardless of the amount.

Beginning the commission week of April 30, 2021, all Associates earning USD $100 or more will be subject to the same deductions.

To illustrate:

| Week 1 | USD $99 | Not subject to deduction and not required to issue an Official Receipt |

| Week 2 | USD $100 | Subject to deduction and required to issue an Official Receipt |

| Week 3 | USD $99 | Subject to deduction and required to issue an Official Receipt |

Q: Aside from the 30% deduction, what will happen to my account if I don’t comply with these requirements?

A: If an Associate fails to comply with the Official Receipt and Commission Release Acknowledgment Form requirements within the prescribed period set forth, the amount deducted will automatically be forfeited in favor of the company without further demand.

Last modified: February 19, 2021